Sustainable investing and its benefits to firms

Sustainable investing, also known as socially responsible investing, is the process of incorporating environmental, social and governance (ESG) factors into investment decisions.

Sustainable investing enables individuals to select investments based on values and personal priorities. Initially, sustainable investing negatively screened companies and industries, which often led investors to sacrifice returns for value-aligned investment choices. In recent years, however, investors have used positive screening of ESG risk factors to create a modern “best-in-class” investment approach that generates performance that is in line with—and often exceeds—market benchmarks.

The growth of sustainable investing reflects investor concerns about the impacts of climate change and other environmental, social, and corporate governance issues on their investments and about the broader impact of their investments on the world. These concerns have been triggered by an onslaught of systemic risks that have emerged so far in the 21st century, which have led to calls for a more sustainable version of global capitalism that encourages a long-term stakeholder-centric approach to corporate management. This approach is finding especially high levels of support among a wide sector of the investing public.

A Framework for Understanding Sustainable Investing

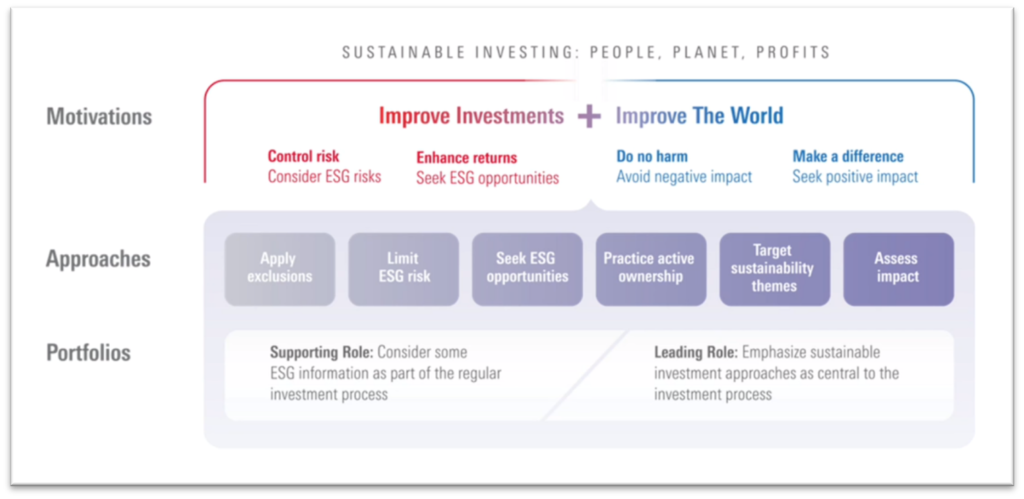

When it comes to selecting Sustainable investments, investors can face a confusing mix of terms and approaches. Because the field has grown rapidly, it lacks consensus on terminology and reflects a variety of ways to apply a sustainability lens to an investment process. Indeed, sustainable investing is not defined by a single, distinct investment approach. Rather, it consists of a range of approaches that has been evolving over the past decade or so. Asset managers and wealth managers have adapted these approaches in various ways to their existing investment processes. These developments have proceeded largely without regulatory guidance, although regulators in the European Union have taken some recent steps in the direction of clarifying terms and the scope of the field. As a result, investors have been left largely on their own to figure out the many facets of sustainable investing. To complicate matters further, an investment considered Sustainable to investor A, may not be considered Sustainable to investor B.

Sustainability (ESG) policies for FCFS models and underlying investment funds

At First Capital Financial Services, we have derived our Sustainable strategy from Morningstar, the internationally renowned investment research firm.

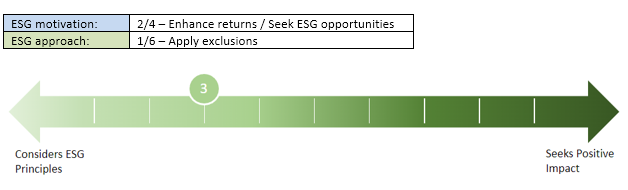

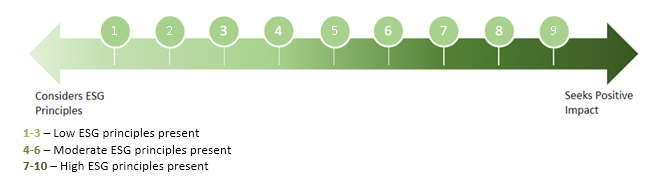

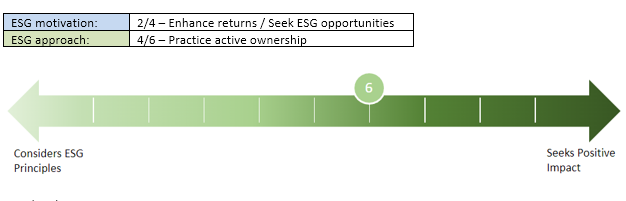

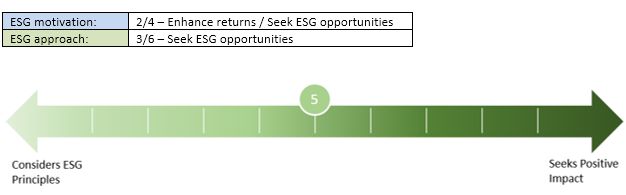

We recognize that Sustainable investing is variable, a continuum across a range of factors. At the lower end of scale, a fund manager may simply use exclusions to restrict certain investments, while at the higher end of the scale, a fund manager may use multiple factors including practicing active ownership, targeting sustainability themes and avoiding particular sectors while seeking to make a positive impact.

We agree with the philosophy that sustainable investing is not defined by a single, distinct investment approach, rather, it consists of a range of approaches. It is also vital to adhere to sensible investment strategies including diversification, assessment of investment objectives, and investment risk management.

Over time, we expect Sustainable investing will continue to develop as the range of investment choices expands.

This approach has derived from the Morningstar model as per the below:

Motivations:

- Control risk / Considers ESG risks

- Enhance returns / Seek ESG opportunities

- Do no harm / Avoid negative impact

- Make a difference / Seek positive impact

Approaches:

- Apply exclusions

- Limit ESG risk

- Seek ESG opportunities

- Practice active ownership

- Target sustainability themes

- Assess impact

FCFS Sustainability (ESG) rating:

Determined by the result of the above in a points system. The highest score is 10, meaning they have scored a 4 in Motivations and 6 in Approaches.

Investment ESG Summary

NZ/Aust Fixed Interest/Bonds

| Kernel Cash Plus Fund | Kernel’s Cash Plus Fund is captured within Kernel’s wider ESG Policy. Kernel utilise a screening process to filter out companies deemed to potentially cause significant social or environmental harm. Environmental considerations include climate change mitigation and adaption, as well as biodiversity, pollution prevention and the circular economy. Social considerations include issues of equality, inclusiveness, labour relations, investment in human capital and communities, as well as human rights issues. Governance considerations include management structures, employee relations and executive remuneration. Significant involvement in the following activities are excluded from the ESG funds: gambling, adult entertainment, alcohol, cannabis, controversial weapons, small arms, military contracting, non-pharma animal testing, tobacco, thermal coal and fossil fuels. Kernel regularly monitors internal and external channels for any potential ESG issues or controversies that may pose a risk to Kernel or its funds, in line with their ESG Escalation and Monitoring Framework. Kernel are considered an index manager which limits their approach to ESG compared to an active manager. Memberships: – None |

International Fixed Interest/Bonds

| Premium Asia Income Fund | ESG considerations are an intrinsic part of the fund’s investment process as it is one of their core beliefs that ESG factors play a crucial role in identifying companies that can generate sustainable returns and resist competitive pressures in the long run. Premium has an ESG committee to ensure comprehensive oversight and governance on the ESG subjects. This committee reports to a leadership team and board of directors to ensure compliance is met. Premium also operates a three-step process of exclusion, ESG risk assessment (their internal ESG scorecard) & post-trade monitoring. Active ownership and engagement are also the fund’s core focus, which hosts discussions with companies to promote ESG awareness and support positive change.  Memberships: – PRI (Principles for Responsible Investment) |

| Metrics Master Income Trust | Metrics engages in responsible investment and is a member of the UN-supported Principles for Responsible Investment (PRI), working to achieve the UN Sustainable Development Goals. Metrics ESG policy states, “Responsible investment is about achieving superior risk-adjusted returns for investors, and this includes considering how the entities in which we invest manage ESG factors. Responsible investing is more than integrating ESG factors into our investment process. It also extends to portfolio construction, transaction structuring, monitoring and engagement, disclosure and reporting, and responding to opportunities to improve… Furthermore, Metrics believes in upholding high ESG standards in the management of our firm and, in particular, in our human resource and supply chain practices. We promote a fair and equitable work environment that respects and values our employees and is free from discrimination and harassment. We prohibit our employees from engaging in corruption in any form. We do not knowingly procure any goods or services from suppliers involved in modern slavery or environmental and social practices that fall below the community’s expected standards.” Metrics has a zero-tolerance on investments involved in the following activities: fossil fuels, tobacco, adult entertainment, weapons manufacturing or distribution, deforestation of native timber and rainforest, political organisations, human rights violations and tax avoidance schemes.  Memberships: – PRI (Principles for Responsible Investment) – A Supporter of the Transition Pathway Initiative – Founding Member of the Australian Sustainable Finance Institute – Asia Pacific Loan Market Association’s Green & Sustainable Loan Committee – Climate Bonds Partner |

NZ/Aust Property

| Dexus AREIT Fund | APN is now owned by Dexus (2021/2022), with Dexus stating that they incorporate ESG criteria into their decision-making. APN Group (APN) aims to apply a best-practice approach to organisational sustainability. The APN AREIT Fund invests in Australian Property Managers. The property management sector focuses on reducing harm, such as CO2 emissions. This is regularly achieved through the use of solar or renewable energy. The fund has a ‘High’ rating from Morningstar Sustainability.  Memberships: – PRI (Principles for Responsible Investment) – RIAA (Responsible Investment Association Australasia). |

| OneAnswer SAC Int. Listed Infrastructure (MBA) | Maple-Brown Abbott (MBA) is the underlying fund manager for the OneAnswer fund. MBA have adopted an ESG integration and engagement investment strategy aligned with the PRI and designed to optimise their ability to affect outcomes and enhance investment decision-making, leading to improved returns. MBA do not screen out any specific sector or company based on ESG considerations; however, it identifies and assesses the ESG risks and opportunities, including climate change, which may impact a company’s long-term earnings growth and valuation. Material risks or opportunities are assessed using the internal framework and discussed through the internal research and analysts’ meetings and ensure that these are factored into the risk-return assessment. MBA are actively engaged with their companies to promote long-term ESG benefits.  Memberships: – PRI (Principles for Responsible Investment) – RIAA (Responsible Investment Association Australasia). |

NZ/Aust Shares

| Castle Point Trans-Tasman Fund | Castle Point seeks investment opportunities in companies that generate long-term shareholder returns and provide substantial environmental or social benefits. Some industries, companies or practices do not have a place in a long-term sustainable society, and these are excluded from the investment universe. Castle Point encourages company boards and management to improve their ESG practices. Castle Point operates two screening methods: negative, of companies to be avoided as determined by their investment committee, and positive, which are those companies making positive impacts in ESG practices. Castle Point employs active ownership to influence positive ESG behaviours and outcomes; if an ESG issue is deemed material, then a formal engagement process is conducted. Exclusions include tobacco products and tobacco supply chains, munitions, nuclear armaments, firearms and the processing of whale meat. Positive screening includes renewable energy, carbon neutral and reduction technology, clean energy and emission reduction technology.  Memberships: – PRI (Principles for Responsible Investment) |

| Hyperion Australian Growth Companies Fund | Sustainability has always been central to Hyperion’s business and investment philosophy. Hyperion views itself as a long-term business owner with more than ten years of investment horizon. Due to this long holding period, they must evaluate the sustainability of their portfolio companies and how they impact all their stakeholders. Assessing the company’s likely long-term effect on the natural environment, including its carbon footprint, is a core part of this stakeholder analysis. Hyperion operates a two-stage investment process: screening for companies that meet strict criteria (Hyperion does not rely on external research departments to run screening) and analysis for ESG and climate-specific factors. Hyperion considers the following important factors: isolation of potential risks, composition and quality of the board, the impact of the business on the climate, company-specific ESG policies and initiatives, and carbon intensity. This analysis extends to a company’s broader stakeholder group, including its supply chain. This analysis ultimately feeds into a company’s ‘Business Quality Score’ and is a factor in the portfolio construction process. The Hyperion policy views poor governance and activities that have a detrimental impact on society or the environment as unattractive investments as the company’s overall sustainable competitive advantage and ability to achieve and implement objectives will be impacted. This can result in stocks being either excluded from consideration for Hyperion portfolios or, in less extreme circumstances, being held below-average weights.  Memberships: – PRI (Principles for Responsible Investment) |

| Simplicity NZ Share Fund | Simplicity has a Responsible Investment Policy that includes all NZ Share fund decisions. The investment committee is responsible for monitoring this policy’s adherence and reporting to the board. Simplicity prides itself on being a social enterprise, and investing responsibly is important for them and their investors. Significant involvement in the following activities is excluded: fossil fuels, alcohol, tobacco, gambling, military weapons, civilian firearms, nuclear power & adult entertainment. Simplicity has a passive investment style, so they incorporate a responsible investing overlay to incorporate these exclusions. The NZ Share fund follows a Morningstar NZ index, and screening is required. The fund currently excludes Sky City, Genesis Energy & Delegates.  Memberships: – None |

International Shares

| Aoris International Fund | Aoris have integrated ESG considerations into all investment ownership decisions since the fund’s inception in 2018. Aoris are active owners in their business and act in the best interest of their clients by engaging constructively and advocating for positive change. Aoris have implemented a three-step investing approach: negative screening based on activity and behaviour, positive selection based on behaviour and an annual ESG review. Their requirement for all companies is to demonstrate a history of positive change and display a plan for the future. With a concentrated portfolio, the managers are able to actively hold annual ESG reviews with the company management, to focus on material issues and highlight where improvement is required. All ESG assessments are conducted in-house by the team analysts to ensure Aoris are at the front of all decisions. Aoris produce an in-depth annual ESG report detailing the work carried out through the year, where each holding sits on an ESG scale as well as voting and engagement records. The fund has received the highest sustainability rating available from Morningstar and in the top 2% of all funds globally.  Memberships: – PRI (Principles for Responsible Investment) – RIAA (Responsible Investment Association Australasia). |

| BetaShares Global Sustainability Leaders ETF (ETHI) | BetaShares’ ethical ETF combines strict fossil fuel screens with a broad set of responsible investing screens, offering investors’ true-to-label’ ethical investment options. The fund applies strict ethical screens to ensure that BetaShares are investing only in companies whose business operations align with the fund’s values. BetaShares complement their screening by monitoring all investee’s companies on ESG-related issues via their established Responsible Investment (RI) Committee to ensure the investees stay aligned with these values. Before applying any additional screening, the initial screening ensures that companies have a carbon efficiency score of at least 60% above the industry average. BetaShares have a passive investment style; however take an active approach to proxy ownership, which is uncommon amongst ETF peers. The fund has received the highest sustainability rating available from Morningstar and is ranked third globally amongst its respective peers.  Memberships: – PRI (Principles for Responsible Investment) – RIAA (Responsible Investment Association Australasia). |

| iShares Core MSCI World ex Australia ESG Leaders ETF | This investment (IWLD) tracks an index that is designed to represent the performance of companies that are consistent with specific values and climate change-based criteria and have high Environmental, Social and Governance (ESG) ratings relative to their sector peers to ensure the inclusion of the best-in-class companies from an ESG perspective. IWLD holds the highest rating of AAA on MSCI ESG ratings since January 2018. The fund ranks in the 94th percentile within the global universe of approximately 34,000 funds in coverage (ref: MSCI ratings). Zero exposure to controversial weapons, nuclear weapons, firearms, tobacco, thermal coal or oil sands. Fund rating of 9.58/10 on MSCI ESG Quality Score. iShares has a passive investment style. Primarily using an exclusion-based approach, the parent company, Blackrock, does participate in company engagement. BlackRock aims to take a standard view in-house regarding engagement and voting policies. It utilises the investment stewardship group to coordinate, communicate and carry out these policies across the 85+ markets and approximately 15,000 shareholder meetings at which BlackRock votes each year.  Memberships: – None |

| Hyperion Global Growth Companies Fund | Sustainability has always been central to Hyperion’s business and investment philosophy. Hyperion views itself as a long-term business owner with more than ten years of investment horizon. Due to this long holding period, it is imperative that they evaluate the sustainability of their portfolio companies and how they impact all their stakeholders. The assessment of the company’s likely long-term effect on the natural environment, including its carbon footprint, is a core part of this stakeholder analysis. Hyperion operates a two-stage investment process: screening for companies that meet strict criteria (Hyperion does not rely on external research departments to run screening) and analysis for ESG and climate-specific factors. Hyperion considers the following important factors: isolation of potential risks; composition and quality of the board; impact of the business on the climate; company-specific ESG policies and initiatives; and carbon intensity. This analysis extends to a company’s broader stakeholder group, including its supply chain. This analysis ultimately feeds into a company’s ‘Business Quality Score’ and is a factor in the portfolio construction process. The Hyperion policy views poor governance and activities that have a detrimental impact on society or the environment as unattractive investments as the company’s overall sustainable competitive advantage and ability to achieve and implement objectives will be impacted. This can result in stocks being either excluded from consideration for Hyperion portfolios or, in less extreme circumstances, being held below-average weights.  Memberships: – PRI (Principles for Responsible Investment) |

Diversified Fund

| Kernel Balanced Fund | Kernel’s Balanced Fund is captured within Kernel’s wider ESG Policy. Kernel utilise a screening process to filter out companies deemed to potentially cause significant social or environmental harm. Environmental considerations include climate change mitigation and adaption, as well as biodiversity, pollution prevention and the circular economy. Social considerations include issues of equality, inclusiveness, labour relations, investment in human capital and communities, as well as human rights issues. Governance considerations include management structures, employee relations and executive remuneration. Significant involvement in the following activities are excluded from the ESG funds: gambling, adult entertainment, alcohol, cannabis, controversial weapons, small arms, military contracting, non-pharma animal testing, tobacco, thermal coal and fossil fuels. Kernel regularly monitors internal and external channels for any potential ESG issues or controversies that may pose a risk to Kernel or its funds, in line with their ESG Escalation and Monitoring Framework. Kernel are considered an index manager which limits their approach to ESG compared to an active manager. Memberships: – None |

| Milford Diversified Income Fund | The Milford investment team look for the best companies as they believe they are those committed to sustainable practices and will deliver better operational outcomes, more robust financial performance and ultimately, higher shareholder returns over time. Milford analyses a company by considering all available financial and non-financial information to understand the company’s exposure to climate change and social harm. Its active management philosophy defines Milford and is acutely aware of their capacity as shareholders to drive positive change. Milford works with company management, boards, and policymakers to help businesses transition to more sustainable models and strategies. Milford prefers to engage and address areas of sustainability weakness or concern; if, in individual cases, Milford concludes poor sustainability practices have the potential to compromise long-term returns or expose investors to unmitigated risk, the security is placed on a proprietary exclusion list. Milford also excludes direct investments in companies involved in the manufacture of tobacco and recreational cannabis, the processing of whale meat, and the manufacture of a broad range of weaponry.  Memberships: – PRI (Principles for Responsible Investment) – RIAA (Responsible Investment Association Australasia). |

Additional Actions:

2016: Controversial Weapons – Confirmed in writing with each Fund Manager any weapons exposure

2022: Russia – Confirmed in writing with each Fund Manager any exposure to Russia following the attack by Russia on the Ukraine.

2023: Israel – Confirmed in writing with each Fund Manager any exposure to Israel following the Israel and Hamas Conflict.